WHAT WILL THE NEW MPAC ASSESSMENT DO TO YOUR TAXES?

The municipal taxation landscape for the southern Bruce County area is changing soon. New, and quite different residential MPAC Municipal Assessments are scheduled to be issued by MPAC in May / June 2020.

This may impact your municipal property taxes for 2021. Let’s take a look at the implications for the Kincardine, Saugeen Shores and Huron-Kinloss local “bubble” area (southern Bruce County). In this post, we explain:

- What are the ramifications for your future Municipal Taxes from the upcoming MPAC Residential Assessments in the southern Bruce County (Kincardine, Saugeen Shores & Huron-Kinloss) areas?

- Who is the Municipal Property Assessment Corp (MPAC)?

- How does MPAC establish your property assessment?

- When do they establish the values and when do they apply? &

- What is the process for the assessment translating to your property taxes?

Please Note:

- southern Bruce County is defined for this purpose as that county area south of Southampton and east of Walkerton/Teeswater – Commonly referred to locally as TheBubble)

- In these uncertain times, this analysis certainly will not play out in a straight line but does represent traditional procedures and

- What are the implications for your future Municipal Taxes in the Bubble? How be we look at the results first? The subsequent sections (2 to 5) provide the detail regarding how these implications were drawn but why not cut to the chase and look at the big picture and work backwards?

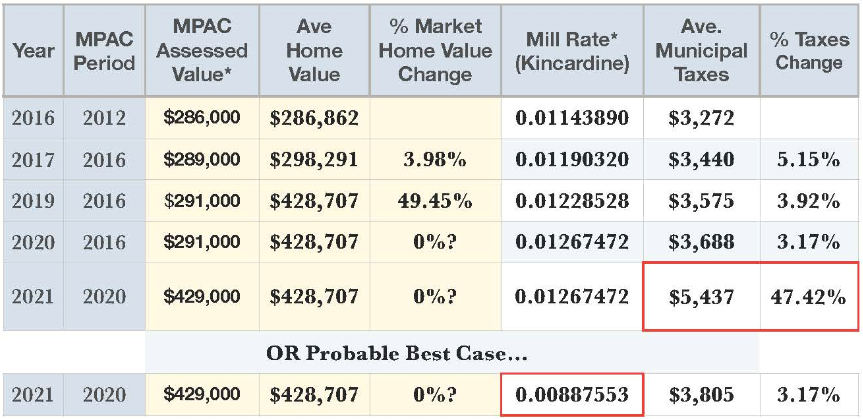

According to Ontario Collective Matrix the average residential house price in 2016 for The Bubble was $286,000. This was when the last MPAC Assessments were done. In 2019 that average residential home price was $429,000 – a 50% increase in value (see Figure 1). It is these 2019 assessments that will be used to determine the 2021 to 2024 municipal taxes.

Looks pretty ominous that our taxes are due for a HUGE increase, right? Well, maybe, maybe not. IF – the current Mill Rate (or Combined Tax Rate) stays the same, we would be looking at 47% tax increase from 2020 to 2021.

The procedure however, is supposed to be that the Mill Rate would be adjusted to meet the Municipal financial needs in the 2021 budget.

So – IF the same 3.17% year over year increase (planned for 2020) stayed the same for 2021, THEN the actual Mill Rate SHOULD decrease from .001267472 (est.) to .00887553 and result in taxes increasing roughly 3.17% again.

We will have to wait and watch as the Municipality adjusts to these dramatically higher residential values and see how they process everything.

Figure 1

Please note:: This table tracks average home value changes over the past recent MPAC Assessments, the resulting Mill Rates ( as per Kincardine Combined Tax Rates 2016-19) and then projects the average Municipal Taxes. Other factors certainly come into play. This is solely intended as representational, not official.

2) Who is the Municipal Property Assessment Corp (MPAC)?

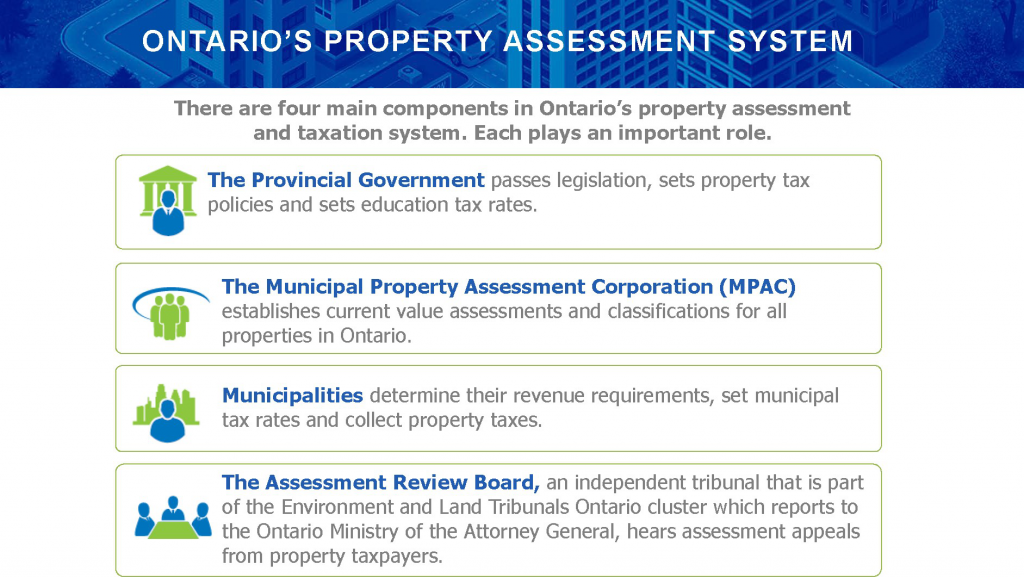

As outlined above, MPAC itself is the second component of the system (see Fig. 2). Working from the Min. of Finance jurisdiction (see ON Min. of Finance),there are approx. 1800 employees (see Fig. 3). MPAC is the legislated body to determine your home’s Assessed Value.

You do have an opportunity to appeal their judgment through the “Independent Assessment Review Panel” (Refer to Assessment Review Tribunal). It is set up as a separate entity in the Attorney General’s jurisdiction. It is worth noting that there used to be a way to initiate a review and put things on hold but it has been revoked. You can still initiate a review with MPAC but their evaluation proceeds to the municipality. The real way to appeal now is to formally create (and pay for) an appeal with the Assessment Review Panel.

Figure 2:

Figure 3:

Figure 4:

3) How does MPAC establish your property assessment?

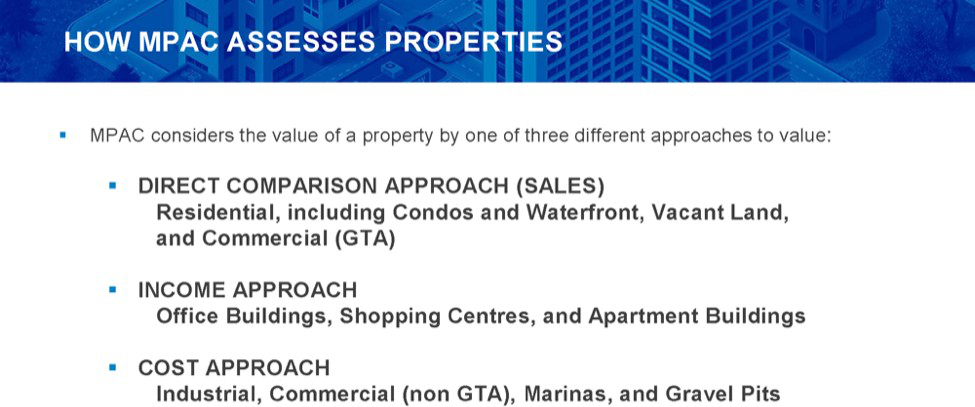

Most of the method MPAC employs to determine your valuation comes from using the Cost Comparison Approach (see Figure 5) considering these five criteria (see Figure 6):

- Location: (general value of the neighbourhood or community),

- Lot Dimensions: (in this case size DOES matter),

- Living Area: MPAC uses residential External dimensions of above ground square footage (excluding garage) to quantify Living

- Age of Property: Unless indicated otherwise via Building Permits (or similar) as updates/ Renos, the newer is a dwelling, the more value it

- Quality of Construction: various ethics are employed to judge the quality of materials, workmanship and fit/finish in a residence. They may visit the interior of a model suite but it is rare to view the interior of a dwelling to establish their

Figure 5:

Figure 6

4) When do they establish the values and when do they apply?

Here’s the kicker. It is correct across Ont. but, as illustrated under the a) section of this document, it has significant impact on our local area.

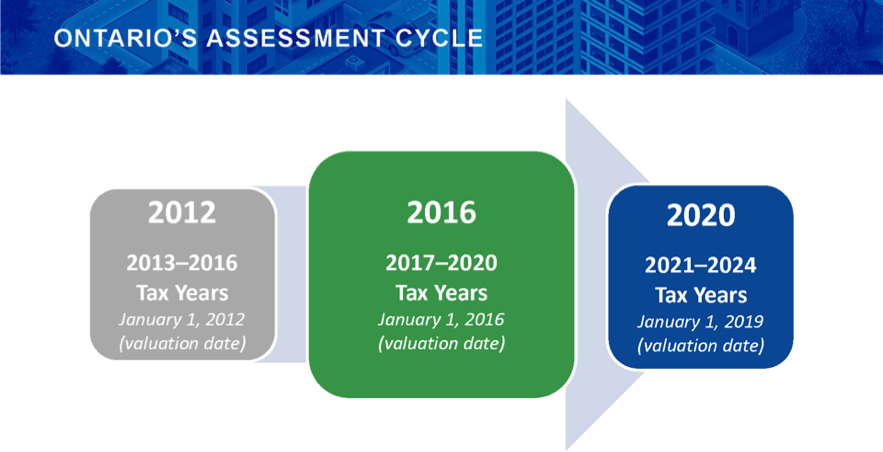

They did Assessments in 2012 (see Figure 7). It was low. This was the basis for Municipal Taxes for 2013-14-15-16. As you likely recall, this was a period where economic activity (read – Bruce Power refurb impact was over) was at a low point and real estate prices were in modest decline.

The next assessment was in 2016 for the Municipal Tax years 2017-18-19. As you also likely recall 2016 was close to the timeframe where the latest economic boom (the Bruce Power Life-Extension Program & MCR Project) was announced. This announcement sparked a resurgence and brisk upward spiral of real estate values that has continued through until at least Q1 2020.

The latest Assessments were done in 2019. This was after 3+ years of these significant increases in values. The new Assessments will be sent out (or at least the plan was before the Covid-19 situation) in May to July, 2020 depending on location. These valuations will be used for 2021-22-23-24.

Figure 7:

5) What is the process for the assessment translating to your property taxes?

Determining Your Taxes? MPAC valuations also get sent to the Municipalities (Figure 2). The Municipalities plan their total financial needs, establish a budget and calculate your Municipal Taxes.

The mechanism that gets applied to your property is the Mill Rate (or Millage Rate or Combined Tax rate).

A Mill Rate represents the amount per every $1,000 of a property’s assessed value. Assigned millage rates are multiplied by the total taxable (assessed) value of the property in order to arrive at the property taxes.

The Municipality creates the Mill Rate by: a) fixing the total desired budget revenue, b) dividing it by the total MPAC Assessed Values for their total jurisdiction,

c) then multiplying by $1,000. This number, once approved, becomes the Mill Rate.

For example, if the locality wants to raise $1 million and the total assessed value is $80 million, divide $1 million by $80 million to get 0.0125. Multiply the result by 1,000 to calculate the mill rate.

In theory, when the valuations of properties goes up and the municipalities needs are steady, the mill rate should decrease. The number multiplied against your newly, much higher assessed home in the Bubble should balance close to the current taxes you pay.

Wanna take any wagers on whether that will be how it turns out?

People often assume that if the value of a particular property doubles, then its property taxes will double as well. This should not be the case. What matters isn’t whether your property value rises or falls, but how property values change throughout the Bubble. If your property doubles in value, but everyone else’s property value doubles as well, your own property taxes will stay exactly the same—relative to the average, you haven’t changed at all. It’s only if your property value increases at a greater rate than the average that your property taxes should go up. Correspondingly, if your property goes up in value, but goes up less than average, your property taxes should actually go down.

A concrete example: let’s say the Municipality has to collect $1 billion, and the average house price is $100,000. If we have House A valued at $50,000, House B valued at $100,000 and House C valued at $200,000, and a one per cent mill rate than the respective houses would pay $500, $1,000, and $2,000 in property taxes. (The mill rate is just the per cent of a property’s assessed value that gets paid in taxes.)

So – where are we? Bottom Line is we are apt to get a shock when we get the letter from MPAC. In almost all cases the number will be much higher. That alone will not be the cause for alarm. We need to wait to see how the Municipalities translate it into the Mill Rate to really see what is our individual impact. There should be about May 1, 2021. Stay tuned?

To learn more contact Morrison MacKenzie mo@momackenzie.com, 519-389.7153